Corporate Investors

OPERATING AS A FIDUCIARY TO ADVISE, GUIDE, & ALIGN CORPORATION NEEDS WITH PROPER PRODUCTS & APPROACHES

OPERATING AS A FIDUCIARY TO ADVISE, GUIDE, & ALIGN CORPORATION NEEDS WITH PROPER PRODUCTS & APPROACHES

As a Registered Investment Advisory firm (RIA), Copper River is also focused on advising corporate treasury departments on best practices in liquidity and investment management. With interest rates now at 4-5% and with new products and technologies coming to the market, corporations are actively seeking unbiased advice and guidance. We are uniquely positioned to provide independent advice on new approaches, as well as alternative investment products in this evolving segment of the market.

Copper River advisory operates in a fiduciary capacity and as an independent firm. This requires us to advise, guide and align our advice to the needs of our clients.

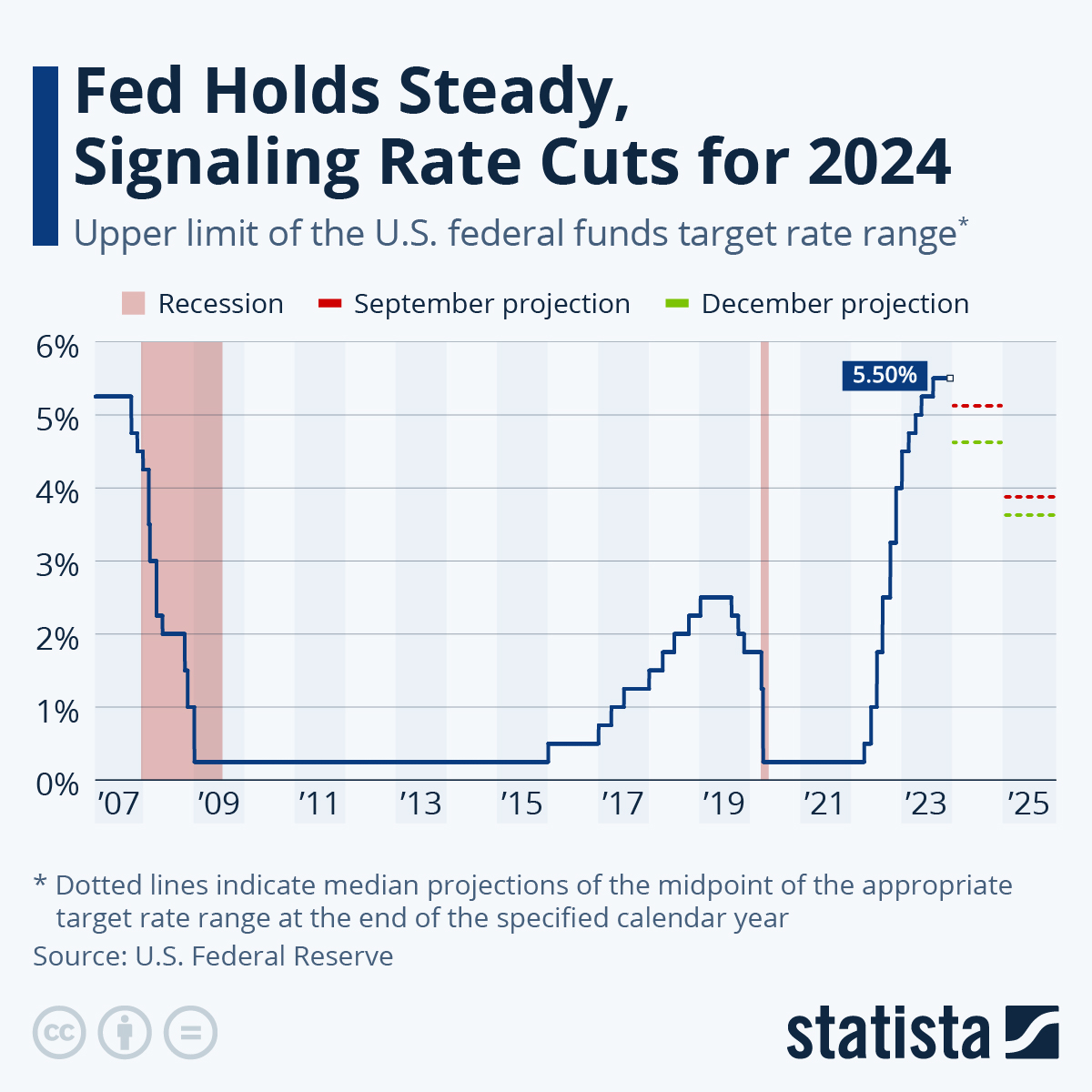

With the Fed Funds rate rapidly rising in 2023, after a decade of historically low interest rates, corporate treasurers are actively seeking ways to enhance yields, as well as explore alternative products to augment their core and operating cash strategies.

Money Funds have been a staple investment for corporate treasury departments for the past decade. However, with possible redemption “Gates” and “Fees” looming over Treasury and Government funds, as well as lower returns when benchmarked to buying a “Treasury Bill” directly, corporate treasures should be aware of new processes and technologies available to achieve their investment goals.

According to Association of Financial Professionals (AFP), Bank Deposits captured over 55% of a corporation’s cash investments over 2023. This percentage has gone up dramatically over the past 5 years, and corporations need to be aware of the risks of being overconcentrated not only to their credit banks, but also the financial sector as a whole. With the high-profile bankruptcy of Silicon Valley Bank, Signature Bank and First Republic Bank in 2023 corporations need enhanced risk and compliance measures in place to monitor where their investments reside and the underlying risks of those investments.